Check out everything you need to know about paying IPVA 2024.

What do you want to see now?

Payment methods, discounts and exemptions

Stay up to date with everything about IPVA 2024

To this end, we have prepared a practical guide on IPVA 2024 so you can understand how the amount of your tax is calculated, how to check payment methods, discounts and exemptions.

In this article you will understand:

Você permanecerá no mesmo site

For 2024, vehicle owners can prepare for the IPVA by following a well-defined schedule. The option to pay the amount in a single installment, with the right to a discount, is valid until January 31st. If you prefer to pay in installments, the payment can be divided into three installments, with the installments due on February 8th, March 8th and April 8th, respectively. This is an opportunity to financially plan the payment of this annual obligation.

Residents of São Paulo can easily check the amount of their 2024 IPVA. By accessing the website of the São Paulo State Department of Finance and Planning (Sefaz-SP), and entering information such as the Renavam number and license plate number, it is possible to obtain precise details about the tax amount. The website serves as a central hub for valuable information about the IPVA, including the amount due, due dates and possible previous outstanding amounts.

To find out how much your car's IPVA will cost in 2024, you can use the resources available on the state DETRAN websites. By providing information such as the Renavam number and the car's license plate, you will have access to exact details about the tax. These websites also offer simulation tools to calculate the IPVA, taking into account possible variations in the rate.

For vehicle owners in Rio de Janeiro, the 2024 IPVA Debt Regularization Guide (GRD) will be available starting January 9. Obtaining this guide is a crucial step to maintaining the vehicle's tax regularity, and can be done through DETRAN-RJ's digital channels.

The calculation of the IPVA for a car is based on the market value of the vehicle, as stipulated by the Fipe Table, which provides an average market valuation for different car models. This value is adjusted periodically to reflect market fluctuations. In addition, each state in Brazil defines a specific tax rate, which varies according to aspects such as the type, age and fuel of the vehicle.

The Motor Vehicle Property Tax (IPVA) represents a crucial aspect of the fiscal and legal responsibility of vehicle owners.

This tax not only contributes significantly to state revenue, which is converted into benefits for society, but also ensures the vehicle's regularity.

Payment of IPVA 2024 is an annual commitment that reflects civic awareness and adherence to traffic and public finance regulations.

Important Points about IPVA Payment 2024

- Contribution to the Public Budget: Payment of IPVA 2024 is a vital source of revenue for state governments, helping to finance essential areas such as infrastructure, health and education.

- Vehicle Legality: Regularizing the 2024 IPVA is a requirement to maintain the legality of your vehicle, avoiding legal problems such as fines and circulation restrictions.

- Licensing Renewal: Payment of IPVA is a prerequisite for the annual renewal of the vehicle's license, which is essential for legal circulation on the roads.

- Vehicle Valuation: Vehicles with overdue IPVA payments may have their market value reduced, while regular payment of the tax maintains its value.

- Possible Exemptions and Discounts: Some states offer exemptions or discounts on IPVA for vehicles owned by people with disabilities, the elderly or older vehicles.

- Digital Evolution: The ease of accessing and paying IPVA 2024 through digital platforms simplifies the process, saving the taxpayer time.

Advantages of Paying IPVA 2024 on the Correct Date

- Avoid Interest and Fines: Paying the 2024 IPVA on the correct date avoids the incidence of interest and late payment fines, reducing unnecessary costs.

- Early Booking Discounts: Advance payment of IPVA 2024 often grants discounts, representing immediate savings.

- Legal Tranquility: Keeping your IPVA up to date ensures legal peace of mind, avoiding unpleasant surprises such as vehicle seizure.

- Facilitates Sale or Transfer: A vehicle with paid IPVA facilitates sales or transfer processes, speeding up bureaucratic procedures.

- Credit Score Improvement: Regular payment of taxes, such as IPVA, can positively influence the owner's credit score.

- Efficient Financial Planning: Paying the 2024 IPVA on time allows for better financial planning, avoiding the accumulation of debts.

Paying the 2024 IPVA goes beyond a simple financial obligation; it reflects a commitment to social order and the maintenance of public infrastructure.

Keeping up to date with your IPVA not only avoids legal and financial inconveniences, but also demonstrates a sense of civic responsibility.

Therefore, punctual payment of IPVA should be seen as an investment in society and in the vehicle owner's own peace of mind.

Trending Topics

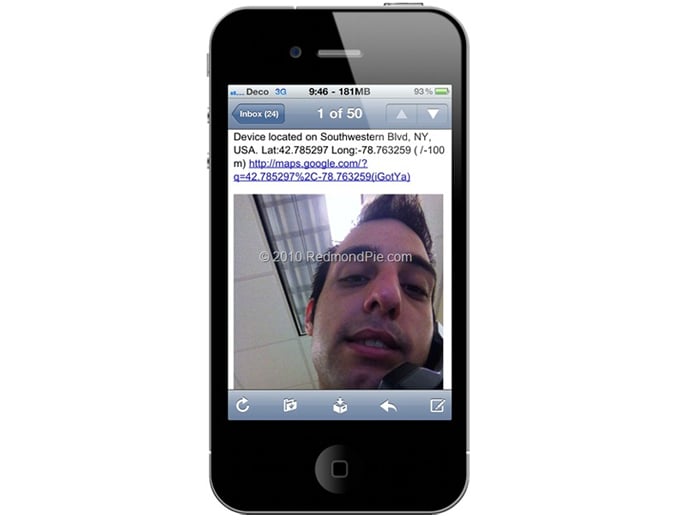

App to take a picture of someone who misses their password on their cell phone: see 5!

Download an app right now to take a picture of anyone who has entered their password on their cell phone and never run the risk of having their security invaded again!

Continue lendo

ROBLOX: The Ultimate Guide to Getting Robux and Promo Codes

Explore Roblox like never before! Learn how to create games, earn Robux, and discover the game's best secrets.

Continue lendoYou may also like

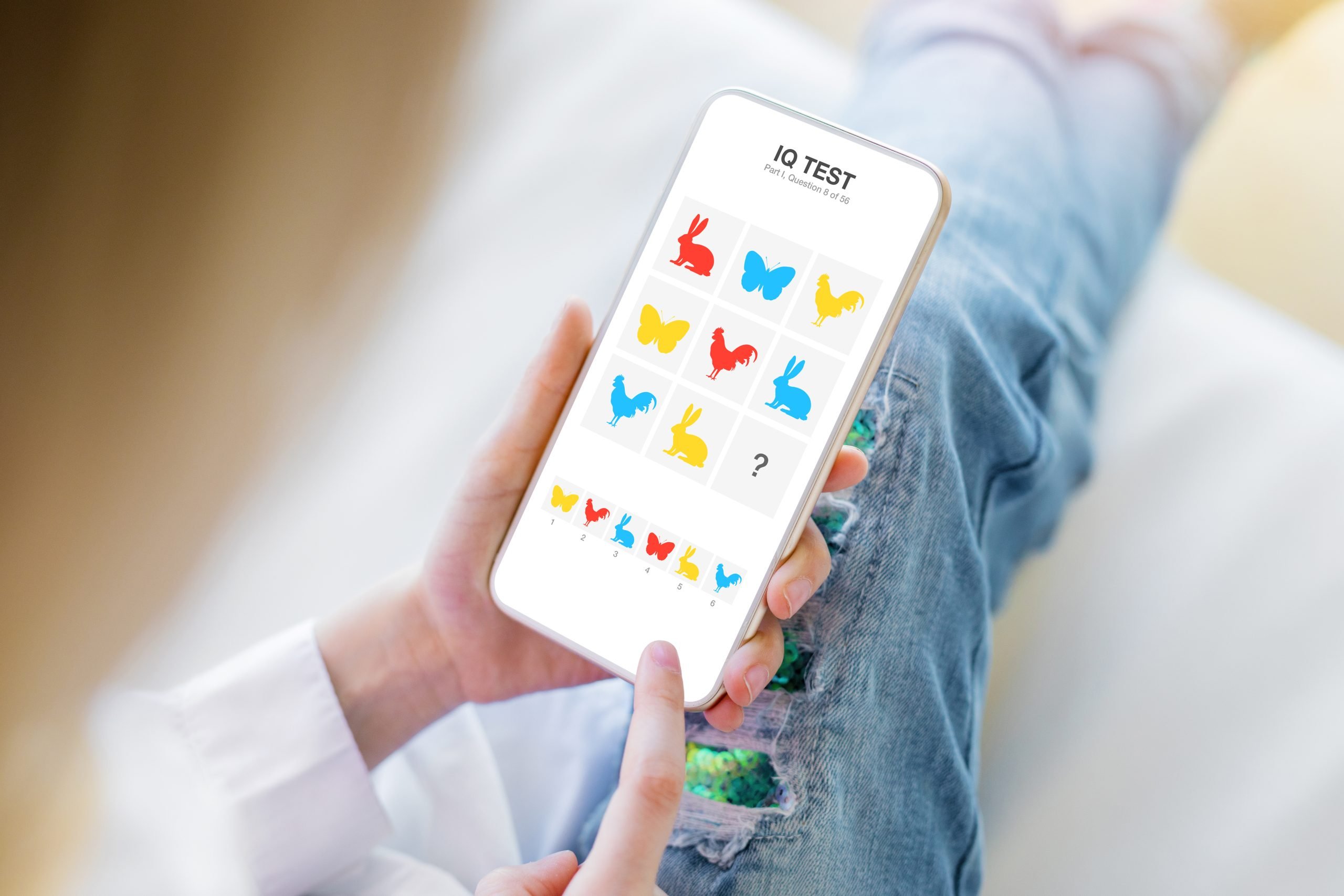

IQ Test Apps: Are You a Genius?

Discover the limits of your intelligence with IQ test apps and challenge your friends to see who achieves the best results!

Continue lendo

Do you know what Smart House is? Make your home smart!

Did you know that you can use simple devices to make your home safer and more technological? Discover the Smart House concept!

Continue lendo

Make money with your smartphone: See the best apps to make money

If you are looking for ways to profit using what you have at hand, be sure to check out this article!

Continue lendo